Answer the question

In order to leave comments, you need to log in

On the mandatory sale of foreign currency

I am an individual entrepreneur, I received money for a transit account. In a bunch of articles on Habré (on average for 2011) it is written that I am obliged to sell the currency. And a bunch of replies:

- not 7 days, but 15 ()

- 0% already needs to be sold.

- they will be punished according to this document: 15.25 clause 3, Code of Administrative Offenses of

the Russian Federation But my acquaintance, an economist-accountant, says that the mandatory was canceled, and as proof he said that:

Instruction of the Central Bank of June 15, 2004 N 117-I and Instruction of the Central Bank of December 29, 2010 N 2557-U have been canceled.

Answer the question

In order to leave comments, you need to log in

The obligatory sale of foreign exchange earnings has been canceled, some individual entrepreneurs transfer the currency to their foreign currency accounts opened for physics.

By the way, VK bank is obliged to advise you on currency legislation, so do not hesitate to ask them. They do not answer - just change the bank, since now there is a choice.

Good luck!

It’s probably not good to promote other resources, but in terms of accounting, forum.klerk.ru is the same as habr in IT. Try to find the info there or ask a question there, as a rule, they answer quickly and competently.

Within 15 days from the date of receipt of money, you must present documents for them and transfer from transit to settlement.

For example, in my case, the operation to withdraw from transit to rs is called “Compulsory sale of currency” in the Internet bank. At the same time, I am obliged to sell 0% of the currency, but if I wish, I can sell part of it.

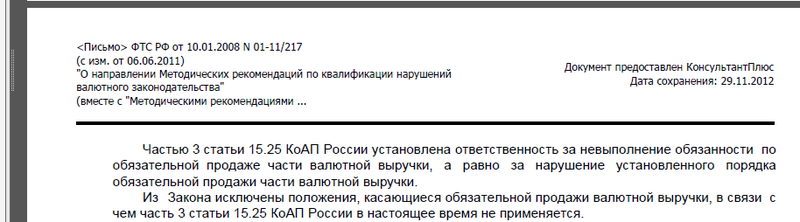

According to the letter of the Federal Customs Service of the Russian Federation of January 10, 2008 N 01-11 / 217 (as amended on June 6, 2011) “On the submission of Methodological recommendations for the qualification of violations of currency legislation” (together with the “Methodological recommendations for the qualification of administrative offenses provided for in Article 15.25 of the Code of the Russian Federation of Administrative Offenses”), the sale of foreign exchange earnings is not mandatory.

Didn't find what you were looking for?

Ask your questionAsk a Question

731 491 924 answers to any question