Answer the question

In order to leave comments, you need to log in

IP on a patent (PSN), work through Upwork - how to do it right?

Hello everyone, Merry Christmas and Happy New Year!

I have been testing, for more than a year I have had an individual entrepreneur on the simplified tax system 6%, as an individual entrepreneur I worked under a direct contract with a customer from the USA. I am served in Alfa (although I plan to close my account there).

For a long time (including before the opening of the IP) he worked, or rather, "left" through Upwork, but since the income was insignificant, I did not take a steam bath.

Since the end of the 18th year, the upwork has “flooded”, this has become the main source of income, and the previous IP contract with a company from the USA has come to naught.

Until December of the 18th year, inclusive, all income from the upwork was withdrawn to the black on a personal ruble card account of an individual. faces.

From 01/01/19 of the new year, I decided to withdraw from the upwork in white ( herethere is my separate topic about this), for which a new account was opened in December with Modul-Bank and wrote in the tax application on the transition to a patent (PSN) from January 1.

In the application for a patent, he indicated the type of activity:

"Provision of services (performance of work) for the development of computer programs and databases (software and information products of computer technology), their adaptation and modification"

But something is now worried - in the last and main at the moment upwork contract name: "QA Engineer"

Question:

Maybe we should ask the customer to change the name in the existing contract to something more consonant with the type of activity in the tax application?

It seems that he wrote that this is real, although it is necessary to act through the support.

And is the name of the Upwork contract important for anything else, like future curls or currency control?

I am not in a hurry to make the first conclusion from the upwork, I plan to make it after the New Year holidays, the VK Module of the bank is resting, I will have to go to the tax office, pick up the patent, make sure that everything is in order.

Thanks in advance to those who answer!

Upd 01/09/19:

Today is the first day, it is extremely difficult to reach the VK module of the bank, perhaps one of you will tell you.

So, I'm trying to withdraw the amount from the upwork (having previously linked a currency account there).

The module support said that they would need 3 documents from me:

https://modulbank.ru/valutniy_kontrol/upwork

1) Extract from the Contract/Agreement:

so you need to print their template:

- put the date of the contract with the one from which the IP conclusions will be, what was "before" is not of interest to them, therefore, set it from 1.1.19

- they said any date of completion, 5 or 10 years

- sign and send in the chat.

2) Print Screen about accruals from Upwork’s personal account

, I’ll do it, no problem

3) Confirmation of services from the Upwork support service - signed on both sides

, printed, signed, sent the upwork, I’m waiting for

item 1) you need to do it once, and you can before entering the transit account, pp2,3 with each receipt of money for tr. check.

I printed it out, signed it, scanned it and sent it to the chat before the withdrawal - they immediately accepted it without questions, they said it was suitable.

ordered a withdrawal of $ 1000 from the upwork, $ 30 was withdrawn by the commission, flew to the tr account 956.26 (as they wrote, the correspondent bank bit off its ~ $ 14) and it came unexpectedly quickly (5 hours may have passed)

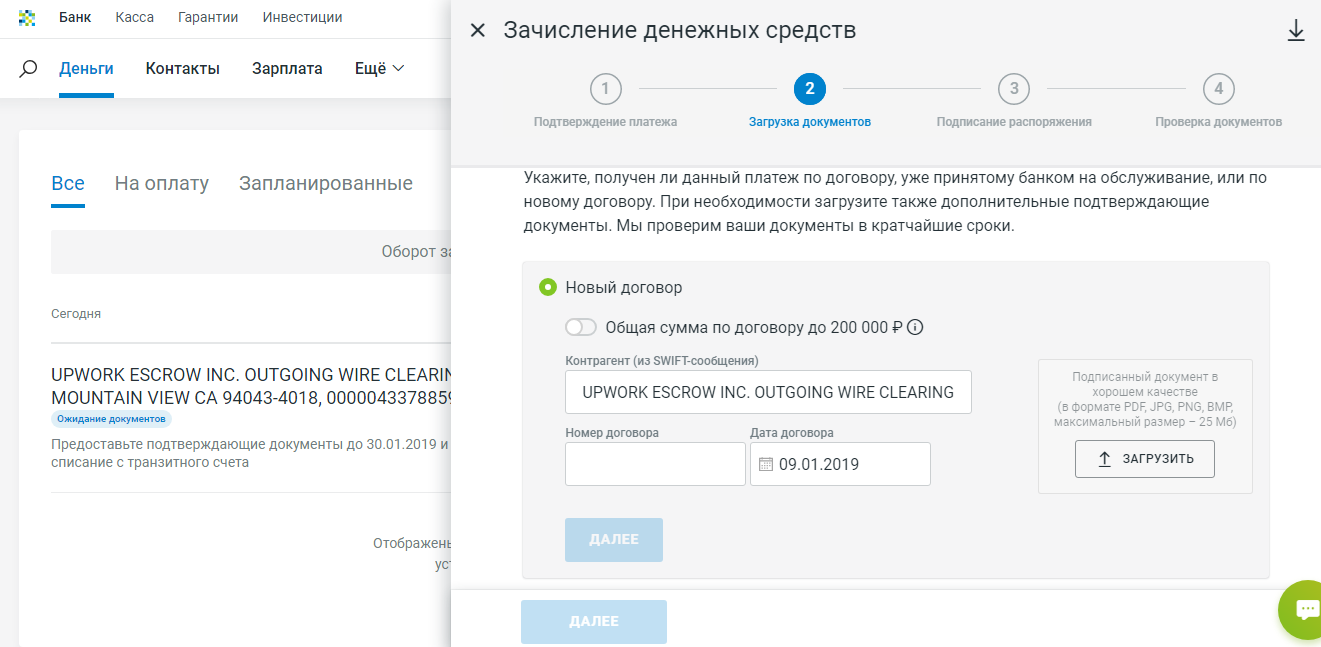

A form appeared in the module - confirm and upload documents:

They do not answer questions yet.

Help me figure out if I need to change the counterparty, number, date to what I scanned and sent?

the extract from the contract indicates Upwork Global inc

and in the bank form from the Counterparty (from the SWIFT message):

"UPWORK ESCROW INC. OUTGOING WIRE CLEARING 441 LOGUE AVE MOUNTAIN VIEW CA 94043-4018, 000004337885917, WFBIUS6S"

the date in the bank form is today, 09.01 and in the extract from the contract I put 01.01

and my number is BN

And what to upload there? this statement accepted by the Module?

p2) I just prepared Print Screen while

p3) did it, but incorrectly indicated the amount - the entire $1000

support of the upwork pretty quickly unsubscribed to me what I need to specify minus the commission, that is, I

sent the corrected version for $970, I'm waiting.

Answer the question

In order to leave comments, you need to log in

In general, in theory, the tax treaty itself is important.

The name can be any of the contract.

I just had something like ongoing work there

Nobody can tell you right now. Because there is no jurisprudence yet. Plus, it takes time until it is formed by region.

What someone somewhere had, of course, is interesting, but this does not mean that you will have exactly the same.

So if you want, use it. Maybe it will pass. Still, IT and Upwork are quite specific, there must be technical knowledge to challenge.

The tax authorities cannot simply say that PSN does not apply. You have to justify.

If you apply, then consider a few points:

1. The patent is valid in the region of issue. But there were many letters from the Ministry of Finance that it applies to remote work and it is important that the contract be concluded at the place where the patent was issued. You will not include this in the Upwork contract. If possible, write in the TOR.

2. Works performed. It will be necessary to confirm that there were works on software development. Therefore, save the TK. Or specify in correspondence with customers. Acts, of course, do not sign. But draw up at least some documents in order to later prove that it was work that corresponds to the patent

3. Be sure to apply for the application of the simplified tax system. So that in the event of a patent being challenged, they would be thrown off to the simplified tax system, and not to the OSNO.

Another point - it seems to me that you incorrectly consider payments under the patent. For some reason, all the time we are talking only about 700 rubles in excess.

But according to the patent, in addition to paying for the patent, fixed contributions must be paid in full + 1% excess.

For example, if the income for the year is 1 million, then the patent fee is + 36,238 rubles. + 7 000 rub.

You have 22,200 for a patent

This means that for the year you will pay a total of 65,438 rubles.

If the simplified tax system is 6%, you must pay contributions in the same amount. But they can be deducted

. That is, pay contributions of 43,238 rubles.

USN tax 6% = 60,000 rubles. , deduct contributions and pay 16,762 rubles.

in total 60,000 rubles.

Therefore, with an income of 1 million a year, a patent is less profitable.

I also work on PSN through Modulbank.

The name of the contract goes nowhere further than Upwork. Currency control doesn't care about your contracts with customers. It is enough for them to provide the translated User Agreement once.

KUDiR lead you yourself.

Purely in theory, the tax authorities may require kudir and contracts during verification in order to check them for compliance with the patent. In any case, you yourself will prepare all the documents and headings - this will be the least of the problems.

Unfortunately, so far there is no information on tax inspections of IPshnikov on a patent.

P.S.

If I understand correctly, from the innovations - from 2019 it will not be necessary to pay VAT? Right?

Do you really think that an accountant will deal with this better? Mind your own business. It will be cheaper. Or do you have nothing to do?

Go to the tax office, they will tell you everything for free. At least we have excellent tax advice, so that everything goes smoothly and everyone is fine.

On a habré or a toaster, I came across somewhere (did not save the link) that a person was asked for KUDiR and demanded to pay the simplified tax system. what was in it did not fall under the patent.

Didn't find what you were looking for?

Ask your questionAsk a Question

731 491 924 answers to any question