Answer the question

In order to leave comments, you need to log in

How to prove to the tax authorities that you are entitled to tax holidays if you work through upwork?

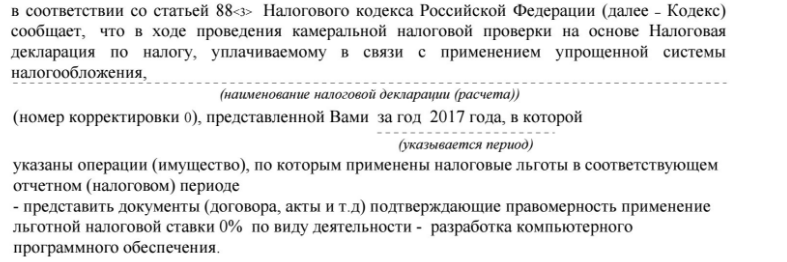

A letter of happiness came from the tax office of this kind. I think comments are unnecessary.

The only thing worth saying is that there is nothing in the upwork in contracts and invoices that mentions that I was engaged in software development.

How to be now?

Answer the question

In order to leave comments, you need to log in

Well, call the tax office to clarify

. In general, there was not much point in getting involved in this, it’s easier to sit out in gray if you don’t pay taxes anyway

A couple of ideas that have appeared so far:

1. If it comes to the fact that you will make contracts with end customers, call them "Additional agreement to the contract-offer" and formulate in the spirit of section 8 of the offer. Justify by the fact that the client had a relationship with Upwork before they did with you, and their payment relationship is actually two-way (despite the fact that the contract does not say so).

2. In theory, it was possible to indicate the nature of the work in the Milestone description, then show the e-mail that comes with its release with a DKIM signature. If the courts now accept e-mail as evidence of evidence, then the tax authorities cannot ignore such documents either.

In general, it was clear from the outset that these benefits and patents had no other purpose than to oblige small entrepreneurs to have documents for every sneeze (with all the side effects). There was no need to take them.

you need to provide documents

, but upwork speaks Russian - ask, maybe there are solutions

not only for local payments ))

The benefits only apply when you develop the boxed software as a complete PRODUCT.

If you provide SERVICES for software modification or administration services, you do not have any benefits.

Well, that is, if you made applications for Android and put them on Google Play yourself, you would have benefits.

Moreover, if you make the same applications for third parties on their order, there are no benefits anymore.

In fact, people go over the ears of the taxman. And they still receive benefits, even if they actually provided services for writing software, and did not create software as a product.

Just talk to the IRS. What documents will suit them.

They have a very large load there - no one wants to cause unnecessary disassembly. Moreover, it is impossible to take normal amounts from you.

Didn't find what you were looking for?

Ask your questionAsk a Question

731 491 924 answers to any question