Answer the question

In order to leave comments, you need to log in

How do I pay VAT on Upwork?

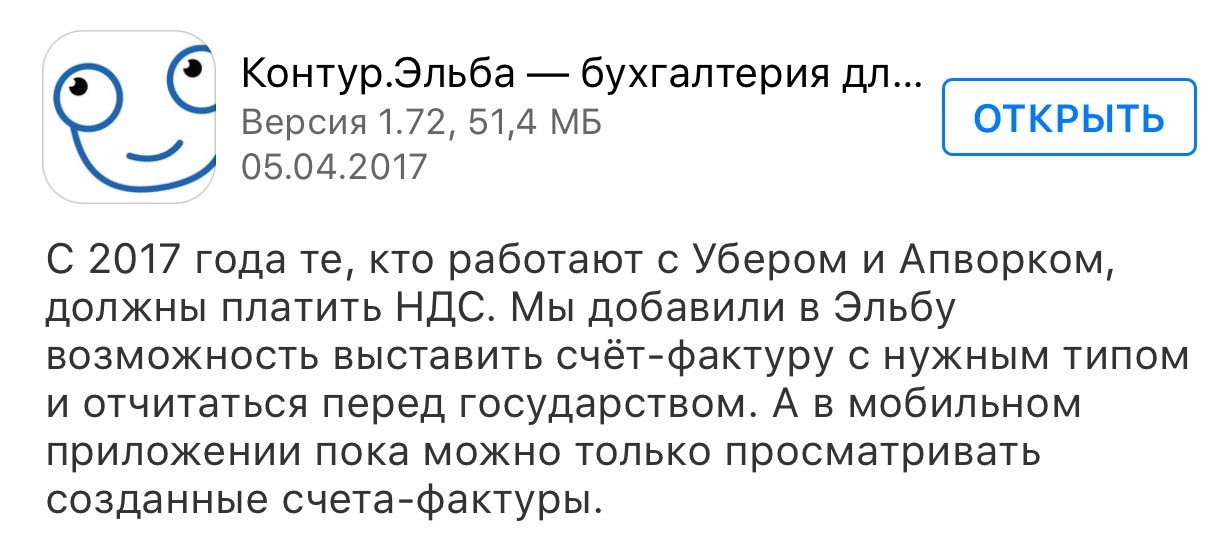

Today, Elba put an end to the debate that unfolded on the toaster , habré and jurist by releasing an update The  question of whether it is necessary to pay VAT is no longer worth it, now the question is how to pay it.

question of whether it is necessary to pay VAT is no longer worth it, now the question is how to pay it.

The tax code today does not provide for the possibility of paying for the services of a non-resident through the withholding of funds. Elba does not assume this either. The crutch that they rolled out today, at the very least, allows you to generate a VAT declaration, but does not allow you to generate payments for paying VAT.

In this connection, the question arises, who pays / declares VAT when working with Upwork?

In particular, are there people here who use the service of my business? How ready was he for changes in NK?

Answer the question

In order to leave comments, you need to log in

Here is the most detailed answer from Elba

Question: In view of the fact that Upwork sends us less money to the bank account than received on the internal account (commission deduction), there is a certain offset, as I understand it, a currency payment comes, is it even allowed to do this with currency payments ? How do I display this in Elba and docs if allowed?

Elba: In this case, you have an agency scheme, that is, you recognize income on the date the client pays the agent (upwork), in rubles at the exchange rate of the Central Bank of the Russian Federation on this date (and not on the date the funds are transferred to your transit account).

To accurately determine this date and amount of receipt, you must have an agent's report, with a detailed list of all transactions.

However, be prepared for the fact that if the exchange rate is higher on the date of receipt of funds to the transit account, you will need to prove to the tax authorities why you recognized income on the date of payment of the client, or rather, that the date of payment of the client was exactly that. Therefore, first check with your IFTS whether the agent’s report will suit them in the form in which you receive it from Upwork.

In Elba, you reflect the income by the date of payment by the client upwork by the receipt operation Other, type "not specified".

I am also dealing with this issue, I asked Elba and the tax office. Here are Elba's expert answers:

Upwork is a foreign organization that is not registered in the Russian Federation.

Thus, you are the principal for an organization that is not registered in the Russian Federation (intermediary services in electronic form), therefore

- on the day the agent (Upwork) transfers the money of clients (minus commission), you must pay VAT (18% of the amount of agent services );

- within 5 days from the date of transfer of money, draw up an invoice in the Documents section, where

- the type of operation "Payment for the services of foreign companies not registered in Russia";

- amount: Upwork commission + 18% (this is the tax base);

- VAT: VAT included = 18/118*(commission + 18%) (this is the amount of VAT payable);

- according to the results of the quarter, submit a VAT declaration by the 25th, in Elba there will be a task to generate a declaration.

*within 5 days from the date of transfer of money* - this probably means the transfer of money by upwork to your account.

The tax agent (you) is obliged to transfer VAT at the time of making settlements with a non-resident (upwork), but since in Elba it is not yet possible to generate a payment order for VAT outside the task, which opens only at the end of the quarter. Then such a payment order must be generated in the Internet bank, or it can be prepared on the tax website https://service.nalog.ru/payment/payment.html

Now I'm waiting for a response from upwork about what date to consider as the date of receipt of proceeds. This will determine the exchange rate for converting VAT into rubles (and, by the way, settlements under the simplified tax system).

To address your concern, your funds availability date is listed on the 1st column of your transactions history.

According to the simplified tax system, an important point is that you need to create receipts yourself:

USN takes into account the full amount of customer payments, without deduction of commission. Income must be taken into account according to the report (registry) of the agent, that is, it must be taken into account exactly on the date of payment of the client, while the money is still even in the virtual account. In Elba, at the time of receipt of funds to a virtual account, you need to create Receipts "for other" and take this amount into account in taxes. When withdrawing funds to a current account, this amount does not need to be taken into account again in the taxes of the simplified tax system.

In short, it turns out that you need to draw up invoices every time the upwork commission is removed (essentially every week, if the hourly contract). According to them, then there will be a task of reporting to the tax office, but you will have to pay yourself through the Internet bank or something else.

Damn pip.

Guys, someone, don't be lazy and please describe in a Habré article how to do everything right now?

I want to open an IP soon and display everything through the IP, but I'm afraid I'll get bogged down in accounting and mess up.

Write a detailed article on how to correctly withdraw from support, how to calculate and when to calculate tax, how and when to calculate VAT, which banks and programs to use.

I think it’s not just me who needs it, but I’m tormented to search the Internet, information is collected bit by bit and is often contradictory

In fact, Upwork itself pays from the funds due to the freelancer (note that the freelancer does not transfer from his bank ruble/currency account), and as a result, Upwork is liable to pay VAT. Although here it was categorically decided that the need to pay is not discussed. To begin with, it is necessary to clarify who bears the burden of being a tax agent. And in general, my eyes wide open from the comments. Let's assume for a second that I'm playing some kind of online game that allows you to make in-game financial transactions using the in-game currency with other participants, buy game currency and sell it for real money (dollars). I agree that if I regularly withdraw funds, this is income that falls under the taxable base, and the legal entity will be required to legitimize the receipt of funds.

I do not agree that the question of the need to pay VAT is not worth it. Elba is not the ultimate truth, and the "new documents" do not have legal force in Russia (they confirm this for Ukraine, in support of Upwork). The last offer has legal force, which says:

Clause 4. Purpose of the site and site services

Clause 6.3. Free provision and job search

Clause 8.1. Services

Item 10: Relationship with Upwork

Clause 11. Third party beneficiary

Clause 13.1. Service Agreements

That is, Upwork is not a freelancer's agent, does not provide sales services, and provides services subject to VAT for free. This is the difference between Upwork and Uber (or AppStore) - the latter are marketplaces. It seems that it is easier to pay a small amount of VAT and forget, but then a number of other questions arise (the mechanism for calculating the taxable base according to the simplified tax system, what documents to confirm this, etc.). As an option, you can pay VAT (cover the rear), and then demand the return of overpaid VAT in court and get a normal legal decision based on the results.

The problem is that the practice has not yet developed and no one actually knows anything))

If you HIRE freelancers on Upwork,

then Upwork is your supplier YOU PAY MONEY. And for a foreign supplier, you are required to pay VAT.

If you are an employee, then when you receive money, you do not need to pay VAT.

I don't understand why you need to pay VAT if you are not a VAT payer. Or does the question concern only registered VAT payers?

Excuse me, one small moment. Are you on OSNO? When USN workers suddenly became obliged to pay VAT, what kind of farce is this?

If foreign companies are required to pay VAT, then let them do it. You, I hope, are still on the simplified tax system, you do not provide services with VAT. What VAT payment in this situation can be?

New article from Elba, but for Uber, not Upwork. Uber has registered since April 1 =(

https://e-kontur.ru/blog/15680

https://habrahabr.ru/post/327130/#comment_10185770

Does anyone have an understanding of how the payment to a pension on a patent works?

very conflicting conclusions can be drawn.

example:

potential income 200k

real income 1kk

how much to pay to the pension:

- 7k \u003d X * 1% -300k * 1% = 1kk * 0.01-3k i.e. as usual (contradicts the comment on the link).

- 8k \u003d X * 1% -200k * 1% \u003d 1kk * 0.01-2k

- not necessary at all (potential income is less than 300k)

Didn't find what you were looking for?

Ask your questionAsk a Question

731 491 924 answers to any question