Answer the question

In order to leave comments, you need to log in

How to pay taxes with Yandex.Money?

Good afternoon!

Given. I am a simplified IP specialist. I'm going to sell an e-book of my own production + one Internet platform for posting user ads. In both cases, the Yandex.Money form will be used to automatically accept user payments.

Question. How to pay taxes on income on Yandex? How do I arrange all this in my case in order to sleep peacefully?

Thank you!

Answer the question

In order to leave comments, you need to log in

The answer to your question is Yandex.Checkout.

Sign an agreement with them as an individual entrepreneur and receive all payments from them to your account in the bank.

so they just withdraw money to your current account pay taxes as usual no difference

1) An IP can work without R / C if it accepts loot in cash ... You need a cash desk, etc. - not your case ...

2) For any non-cash payments, the IP MUST open a bank account for the IP. Your account physics will not work. Moreover, it is safer to distribute them to different banks. The tax office will track your IP account, and the bank will knock on the tax office on the movement of money through it. Physicists can get to the bottom of your account only in case of obvious violations ...

Even more ... if a physicist, not being an individual entrepreneur, receives income, he is obliged to notify the tax at the end of the year. Oh, and pay taxes. If this is a one-time activity, then they will kill it without an individual entrepreneur ... If it is frequent, then you can fly into illegal business ...

Look at how to collect money to the Yandex account during the year. Withdraw them at once and pay taxes, like a physicist, as a one-time activity (you save on opening / closing an individual entrepreneur and maintaining accounts). But it is better to speak this matter with a tax lawyer. It will also depend on the amounts... and your other left income. Thus, it is possible to speak about the systematic conduct of entrepreneurial activity by an individual, even if during the calendar year he made only two paid transactions aimed at making a profit. Read

www.kadrof.ru/articles/3398

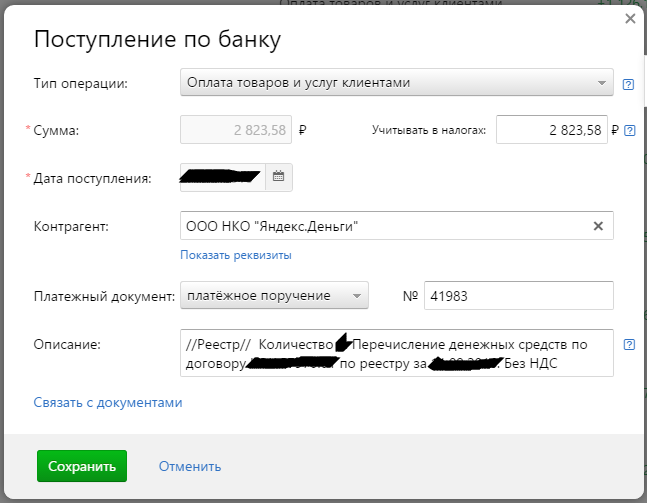

Conclude a contract, indicate that you are on the simplified tax system. Then integrate into your service and start accepting payments.

The money comes the next day to the account in the bank. Also, every day at night, registers come with a report on receipts.

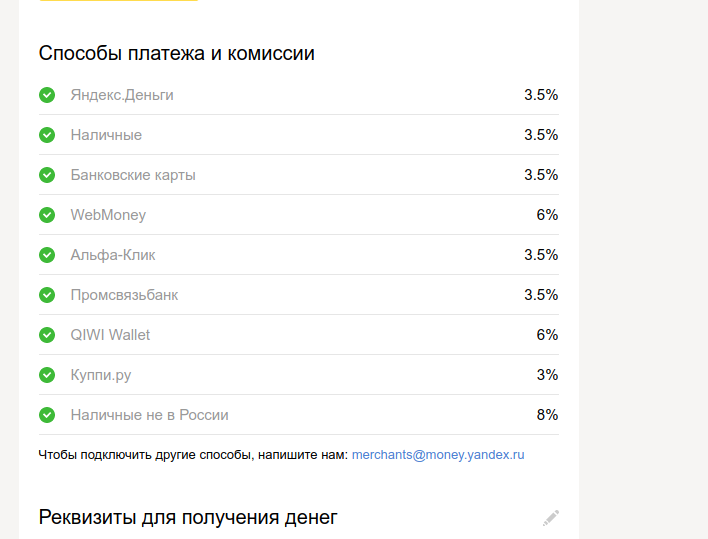

As already mentioned above, the most legal and most expensive way. Open a bank account, conclude an agreement with the Yandex cash desk, the money comes in 1-2 days. The cash desk takes a commission from the payment, but the commission is higher than if you simply accept it as an individual at the same cash desk. Pay taxes on profits if you have a simplified tax system, then either from profits of 6%, or income minus expenses of 15%. Here you choose yourself. In general, it all depends on the turnover, if large turnovers are planned, then there is a sense, if not, then as an individual it is easier.

As an individual and a legal entity without an agreement

As a legal entity with an agreement

First, ask Yandex.Money support about how they withdraw to the current account and with what justification.

And then withdraw to your account and pay taxes on it.

Didn't find what you were looking for?

Ask your questionAsk a Question

731 491 924 answers to any question