Answer the question

In order to leave comments, you need to log in

How long can you not bother with sales on the site without registering a legal entity?

Very often on websites I see how something is being sold without registration of a legal entity. Someone articles, someone else some piece. It is understood that it is necessary to take good shape, but the question is - how long can this be left unfinished?

Those. if I sell something like access to articles or something like that, then I just hang Robokassa and everything is cool. However, they write to me (well, not on the site, but in other discussions) that if you do not take shape, then this is an illegal business activity. On the other hand, other people refer to the fact that one dick if necessary - you can "go" to the tax office and pay the tax, it will just be higher. As for example if you sold a refrigerator to a neighbor.

Guys, if you have practical experience, tell me how to be? I don’t really want to take shape when the annual income from my bondage is less than 200 thousand rubles.

PS I’m more worried that it’s not the tax office itself that will come to me (what the hell do they need me with such a turnover?), but that someone will snitch. And here is the question, so as not to pay a fine, but to say, like guys, although I am not a legal entity, I paid the tax for everything.

Answer the question

In order to leave comments, you need to log in

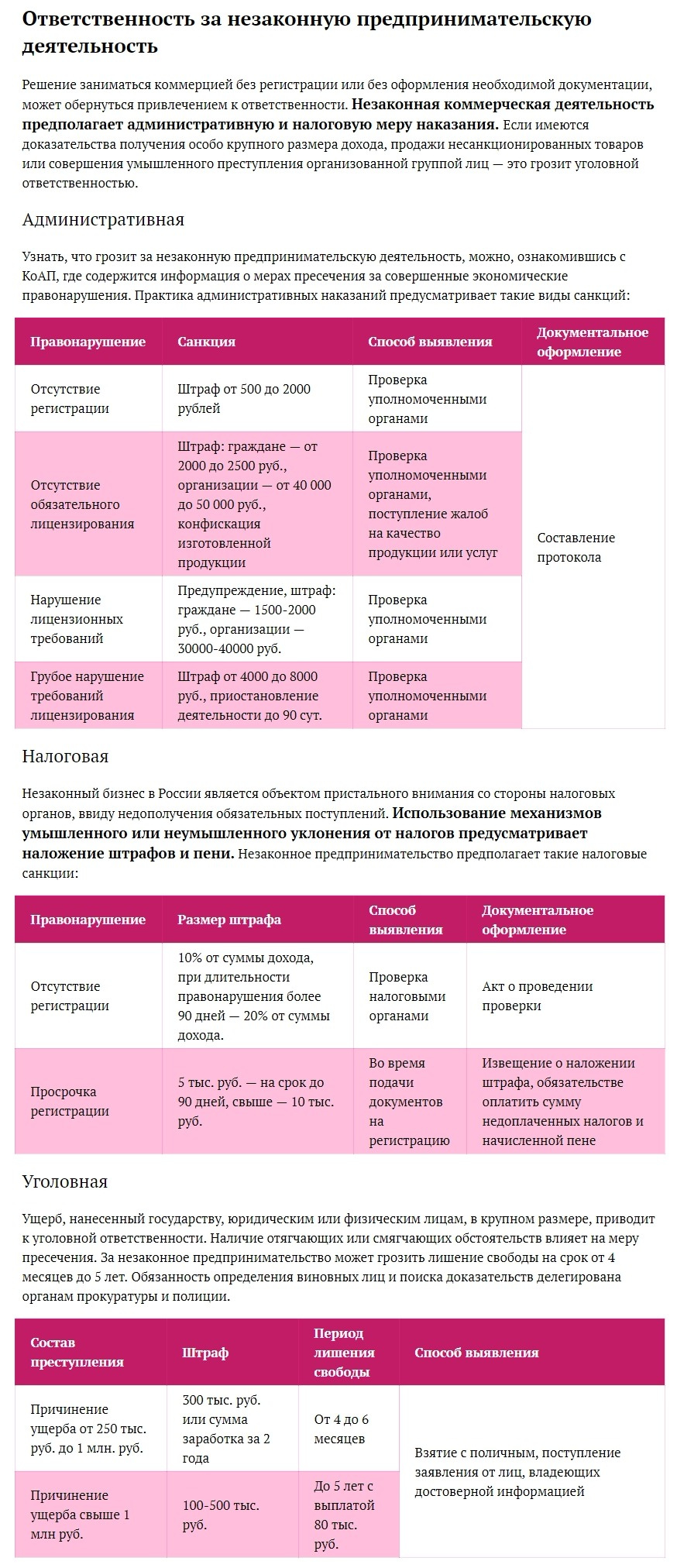

1. The statute of limitations for tax crimes is 3 years.

You will have 200k * 3 = 600k turnover during this period.

The tax office will slap:

20% = 120k fine

and (attention) will carry out additional tax assessment at its discretion, as if you had a legal entity: based on mandatory contributions to funds, this is about 50% of the original amount = ~ 300k.

In total, you easily gain damage to the state over 250k - with all the delights of criminal punishment and an additional fine within it.

2. In the country as a whole, the screws are being tightened on the topic of tax discipline and combating money laundering.

Even for amounts of 100-200 tr, a justification of their origin may be required.

The presumption of innocence does not work.

3. Based on the foregoing - I adviseto all those who have noted here (@InoMono Padre Valentin ) do not create problems for themselves out of the blue, but open an IP. 6% from turnover, 1-2% for cash withdrawal - and you are completely clean before the state.

Accounting can be done in any fashionable online service, reports are submitted with one button once a year.

Remember where you live.

There are more elegant ways for individuals to sell goods through intermediaries, who then withdraw funds to electronic wallets and other things.

Problems begin when you need to do automation so that users can easily pay, and then you do something for them on your service. Here it is already difficult without a full-fledged integration.

cmohammedmedkeveo , with your 200 k / year - you are the elusive Joe.

A receipt is required to make a sale. A check can only be issued by a registered person. If the check is not asked, you can score.

According to experience, legal entities come to registration when it is necessary to enter into PARTNERSHIPS with another legal entity.

You open the IP and do not worry. Either you work further, most likely nothing will happen (in 99% of cases).

At least your entire career. But officially, of course, it's better to take shape.

Didn't find what you were looking for?

Ask your questionAsk a Question

731 491 924 answers to any question