Answer the question

In order to leave comments, you need to log in

All those working abroad must sell the currency received in two months. Where to get it?

The question is relevant for ALL IT specialists legally working for a foreign company who have a current account to which a salary in foreign currency comes.

Now you are obliged to sell all foreign exchange earnings credited from January 1, 2022, and the decree does not indicate what to do if this money is no longer there - you spent it on aliexpress, transferred it to a personal card, sold it on the stock exchange from a personal card, etc. .P. And you had every right to this as an individual entrepreneur, it's your money. Term 3 days, responsibility up to criminal.

What are the considerations?

Answer the question

In order to leave comments, you need to log in

I will express the opinion of another guy from the Internet:

The law concerns current balances, i.e. has no retroactive effect. You cannot sell what you don't already have. For insurance, you can sell all the currency currently available, and in the future follow the law by selling 80% of the incoming currency.

I also recommend subscribing to the Consultant / Guarantor or contacting professional auditors, in the near future there will be clarifications on the implementation of the law both directly from the tax office and from specialized lawyers.

In the TG channel https://t.me/smutnoevremia they posted an explanation from the alpha bank on your question, see point 4:

Friends, I received clarifications from my bank (Alpha) about the mandatory currency exchange for legal entities, it may come in handy for you (below in the message There is a FAQ):

On February 28, the Decree of the President "On the application of special economic measures in connection with the unfriendly actions of the United States of America and foreign states and international organizations that joined them" was published.

What will change in connection with this decree:

1. From March 1, 2022, the following will not be made:

- payments by residents in favor of non-residents in foreign currency as a loan;

- payments by residents in foreign currency to their accounts opened with banks abroad and other financial market organizations (for example, with a broker or a fund)

- transfers without opening an account using electronic means of payment from foreign payment service providers.

All such payments will be rejected

2. From February 28, 2022, exporters must sell 80% of foreign exchange earnings:

- 80% of the amount of foreign exchange credited for the export of goods, services or intellectual property. All contracts are considered from the date of enrollment on January 1 to February 28, 2022. Residents participating in foreign economic activity need to sell them no later than March 2, 2022.

- 80% of the amount of foreign currency credited for the export of goods, services and results of intellectual activity (with and without UNK). All contracts are considered from the date of enrollment on February 28, 2022. Residents participating in foreign economic activity need to sell them no later than March 2, 2022.

We will be able to accept only those orders to debit funds from the transit account, where there is an amount of currency sale and it is not less than 80% of the amount credited. Other orders will be rejected.

Frequently Asked Questions

1. I am submitting a debit order from a transit account, do I have to sell at least 80% of the proceeds?

— Yes, if the money was credited to the transit account after January 1, 2022.

2. I use export earnings for further transfer under an import contract to a foreign counterparty, can I do this?

— No, you need to sell at least 80% of the amount of export earnings received from January 1, 2022. For further transfer under the export contract, you need to buy the currency in the required amount.

3. I received the export proceeds to the transit account and have already transferred it to the current account. Should I sell it too?

- If you received it from January 1, 2022 and it is on your current account, then yes. It is necessary to sell 80% of the amount received no later than March 2 of this year.

4. What should I do if I spent the received export proceeds, transferred under an import contract or sold in full?

- Nothing, since you do not have any currency in transit or in foreign currency settlement accounts.

5. If I am an individual entrepreneur and transferred the received export earnings from the current account to my account of an individual, am I obliged to sell 80%?

- No, this requirement is only for legal entities, individual entrepreneurs and individuals engaged in private practice in accordance with the procedure established by the legislation of the Russian Federation (for example, notaries or lawyers).

6. How long do I have to sell 80% of my export earnings?

— Depends on the time of receipt of money. If in the period from January 1 to February 28 of this year, then you need to sell before March 2, 2022. If after February 28, then up to three working days from the date of enrollment.

7. At what rate can I sell the currency?

— There are no restrictions on the choice of the type of course, any of your choice.

UPD Bank explained it this way: we have a fixed rate and a dynamic one, which changes every second and you can adjust the rate to be profitable.

8. Can funds be credited to residents' accounts in foreign banks?

- It will not work to your account in a foreign bank or other organizations of the financial market. It also cannot be sent to the account of other residents as a loan. In all other cases, transfers to residents in foreign banks are not limited.

transfer the received money into shares of Microsoft or any other company with stable growth and, if necessary, sell by acquiring rubles.

I think that this applies only to the money that you have now.

Not all receipts, but 80%. I see it in the text of the decree right now.

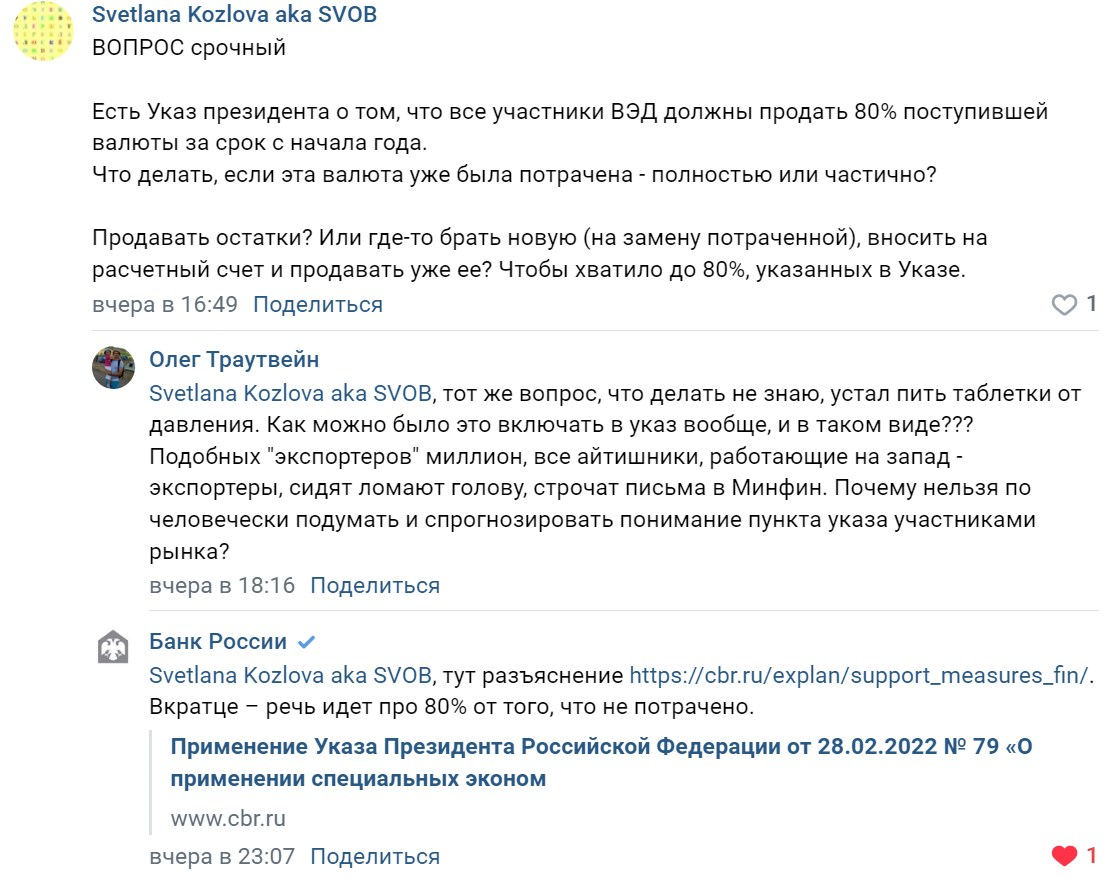

APD Here is what they answered me in their official VK:

Here is the link

Clarification of the Central Bank (I recommend reading everything):

How is the amount of foreign currency received from a non-resident from January 1, 2022 determined, in respect of which the mandatory sale of foreign exchange earnings by a resident participant in foreign trade activities is provided?

Updated: 03/02/2022

Calculation of 80 percent of the amount of foreign currency subject to mandatory sale is carried out by a resident participant in foreign trade activity independently from the amount of the balance of foreign currency held in accounts (including transit currency accounts, settlement accounts, deposit accounts) of a resident participant in foreign trade activity as of as of February 28, 2022 and received from export activities in the period from January 1, 2022 to February 28, 2022. In order to confirm that such a foreign currency balance is export earnings, the said resident provides the authorized bank with information substantiating the balance of export earnings on the account (accounts) of the resident participant in foreign economic activity, confirmed, among other things, by account (account) statements.

Hello,

I am an IP.

On March 7, I received foreign exchange earnings to my settlement account in Modulbank, which I withdrew to an individual's account in another bank (Sberbank) and withdrew from the account without any problems.

Now I received a notification from the Bank's Module that it is necessary to confirm the sale of 80% of foreign exchange earnings.

It's about a very small amount of $2K USD

Question. I violated something by withdrawing dollars from the account, and then selling them in some bank / exchanger (I don’t remember which one and didn’t save the checks).

This is especially interesting in the context of the answer from Alfa Bank given above:

"5. If I am an individual entrepreneur and transferred the received export earnings from the current account to my account of an individual, am I obliged to sell 80%?

- No, this requirement is only for legal entities, individual entrepreneurs and individuals engaged in private practice in accordance with the procedure established by the legislation of the Russian Federation (for example, notaries or lawyers). "

Judging by this, I should not sell anything at all, from what I withdrew to the account of an individual (and say spent)

Thank you.

Didn't find what you were looking for?

Ask your questionAsk a Question

731 491 924 answers to any question