Answer the question

In order to leave comments, you need to log in

How to design analytics?

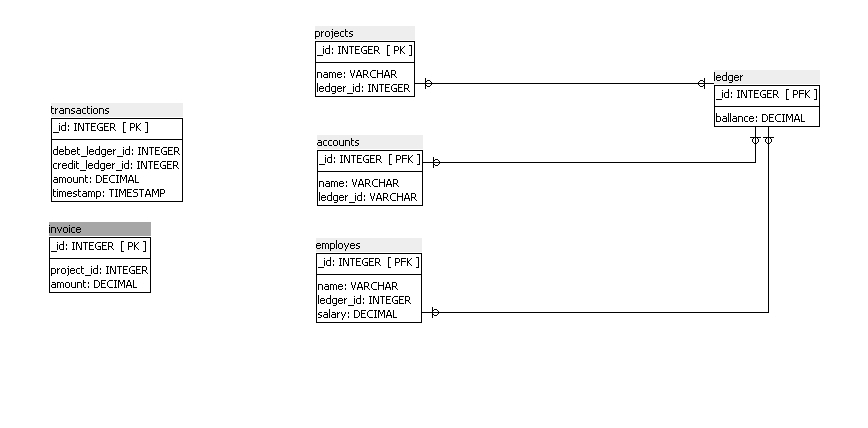

I want to design a small account. There are projects, employees, bank accounts. I have read that it is good practice to double-entry for this. But I have a problem in understanding. I made such a simplified scheme

of invoices - invoices issued for the project

projects - projects

accounts - bank accounts

employes - employees and their RFP

transactions -

ledger transactions - Registers (synthetic accounts if correctly named)

I want to see constantly what is now on the bank accounts , and project balance.

Schematic description of transactions

Accrual

of RFP Withdraw

money from the bank account register (accounts.ledger_id)

Accrue to the employee register (employes.ledger_id)

Calculation of payment for the project (Invoicing)

Withdrawing money from the project register (Project balance goes negative) (projects.ledger_id)

?? But where do we transfer them

Calculation of payment

We accrue the amount to the bank account register (accounts.ledger_id)

??? But it's not clear where to get it.

We accrue the amount to the project register (projects.ledger_id)

?? It is not clear where to shoot

. I wanted to do semi-posting, without the so-called double entry. But when calculating the payment, it still turns out to be a jamb, tk. we accrue the same money on 2 registers. How to do it right so that you can always see the balance on the accounts and debts on projects? I want to do it right, so that later it would be possible to increase the functionality.

Answer the question

In order to leave comments, you need to log in

Double entry was invented just for the purpose of proper accounting. With double entry, no amount can be taken "out of nowhere" or transferred "to nowhere." And things like a project, an employee, a bank account, etc. - are analytics within a transaction. Accordingly, there is debit analytics, and there is credit.

With this approach, the described problems will not be.

Calculation of payment for the project (Invoicing)

Withdrawing money from the project register (Project balance goes negative) (projects.ledger_id)

?? But where do we transfer them?

If you have done work on the project for 100 rubles, then the project has risen in price by these 100 rubles. So you need two accounts - on one to take into account the cost of the project, and on the other - expenses.

I did this: there is an abstract entity account, and an abstract entity - posting. The posting has two links - account from and account to. The transaction also has an amount field.

Then we make a system of accounts: external sources of money - one account, external consumers of money - another account. All internal stores of money - employees, materials, warehouses - are also accounts.

And then it turns out like this: if money was dropped to us from the client - posting from the outside to the inside to the "safe" account marked "from the client". It is necessary to accrue RFP - we make H postings from the safe account to the accounts of "Ivanov" / "Petrov" and so on.

To understand the balance of the "safe" account, you need to count the amount of incoming transactions minus the amount of outgoing transactions.

There can be as many internal accounts as you like. It is possible to count the balance on external accounts, but they are one-sided - either a source or a consumer - it is better not to mix them.

Something like this.

If you want to keep records in a double entry system, then you first need to understand its essence. The balance sheet consists of Assets (funds in any form - money, materials, goods, fuel, receivables, etc.) and Liabilities (obligations to other persons - creditors, employees, tax authorities, banks, etc.). Assets are ALWAYS equal to Liabilities. All transactions show the movement of money between assets and liabilities. For example, assets - cash on hand, liabilities -

debts to employees. The operation is the payment of salaries. The result is a decrease in cash on hand (assets) and a decrease in debt to employees (liabilities). This is a very simple example. Everything is much deeper and more complex.

Didn't find what you were looking for?

Ask your questionAsk a Question

731 491 924 answers to any question