Answer the question

In order to leave comments, you need to log in

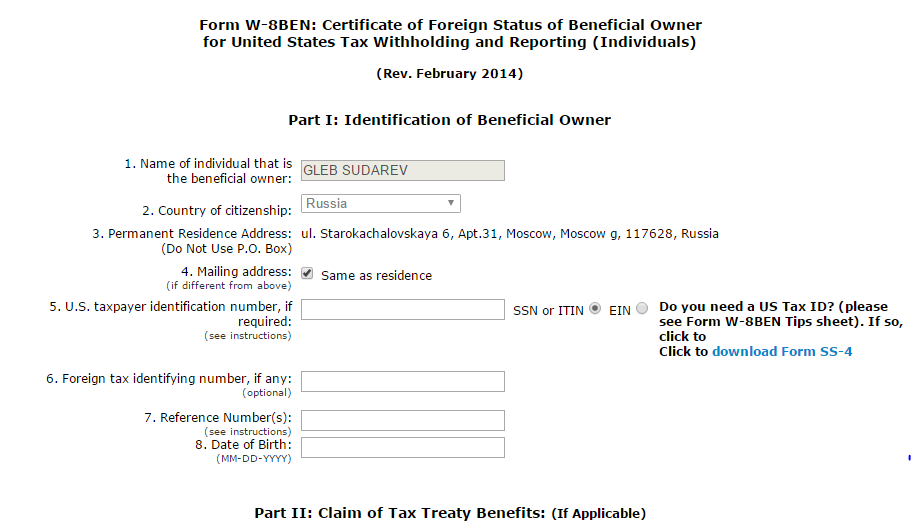

Form W-8BEN: Certificate of Foreign Status of Beneficial Owner... What is required?

Hi everybody. Tell me who knows. In itunes, in the "Agreements, taxes and banking" section, you need to fill out Tax information. What are the required fields? These fields are of interest:

Part I: Identification of Beneficial Owner

.....

5. US taxpayer identification number, if required

6. Foreign tax identifying number, if any

7. Reference Number(s)

Do I need to fill in these fields at all if I do not plan to operate in the USA?

Part II Claim of Tax Treaty Benefits: (If Applicable)

which income checkbox should I put if the income will go through the In-App Purchases model?

Please help those who really know and dealt with this issue.

Screenshot

Answer the question

In order to leave comments, you need to log in

5. - nothing, you won’t get SSN, ITIN has troubles, but you don’t need it either

6. your TIN

7. you also

need to fill out nothing, US taxes are paid, including from payments FROM payers in the USA (from royalties to alimony), here for this you fill out the payer

Didn't find what you were looking for?

Ask your questionAsk a Question

731 491 924 answers to any question